Tesco’s shortage of products including Marmite and PG Tips is “just the beginning” of an epic battle between retailers and brands after the Brexit vote, according to a former buyer for the supermarket.

Bruno Monteyne said the battle between Tesco and Unilever would spread to “every damn retailer in the UK” and prices of products from other manufacturers would rise because “you can’t deny reality”.

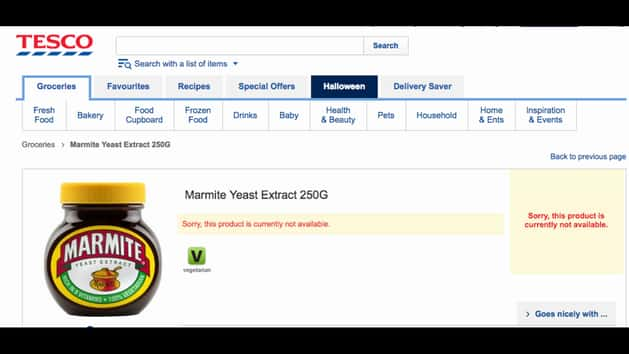

Products including Marmite, Flora, Pot Noodle and PG Tips have been removed from Tesco’s online after their manufacturer Unilever reportedly demanded a 10% price rise due to the falling value of the pound.

They are also running low on shelves after Unilever reportedly halted deliveries to Tesco when the supermarket refused to agree to the increase.

Monteyne, who used to handle Tesco’s suppliers, told BBC Radio 4’s Today programme Tesco and Unilever were “two gorillas” fighting on behalf of their industries.

“Clearly, when the currency drops by 14 or 15%, the shampoo produced on the continent will be 15% more expensive. There’s no denying that fact. Currency has a huge impact. Whether it’s produced on the continent, or you have to bring in commodities.”

Other products not currently on sale online include Magnum, Chicken Tonight and Knorr, as well as household brands like Comfort, Surf, Lynx and Domestos.

Host Nick Robinson pointed out that Marmite is made in the UK, so suggested its price should not be “to do” with the value of the pound.

“Clearly they will be importing some ingredients for making the Marmite,” Monteyne responded.

“Most importantly, this is the only the start of the negotiation process,” he said. “The fact that suppliers increase prices is normal. Retailers push back and say ‘hey, is this a fair allocation’. [The price increase request] is across all [of Unilever’s] products”.

“This is part of the usual process. What’s expectational here is probably the scale of the move, we don’t often have a Brexit event, and given the scale of the event obviously the impact Unilever has to make is bigger. I also think that both Unilever and Tesco are trying to be the two gorillas on behalf of the industry, to go and get a settlement.”

“This isn’t about Tesco, this isn’t about Unilever, it’s every damn retailer in the UK and every supplier in the UK and given they are the biggest ones, they can probably fairly negotiate for a fair settlement.”

Today’s business presenter Dominic O’Connell said Unilever’s finance director Graeme Pitkethly “pointedly ignored” questions about Tesco at a press conference this morning.

Pitkethly said prince increases were a “normal part of business” and “a devaluation-led cost increase was a normal course of affairs for Unilever as it is a multinational,” Today reported.

Pitkethly said Britain makes up 5% just of Unilever’s business.

“It’s a good fight,” O’Connell added, “Tesco is the world number two in retail, Unilever the world number two in groceries. A good fight.”

He said he was confident that the prices of Unilever products would go up. “Obviously there will be a price increase, you can’t deny reality, but whether it will be 10%, most likely not.”

Laith Khalaf, Senior Analyst at Hargreaves Lansdown said the pricing spat was “likely to be the thin end of the wedge when it comes to relationships between UK retailers and their suppliers, in light of the pressures now applied by weaker sterling.”

“This kind of friction is an inevitable result of the unstoppable force of higher import costs hitting the immovable object of UK retail pricing.

“A lower pound helps exporters and has certainly given the UK stock market a leg up to record levels, but the dark side of a weaker currency is that it leads to more expensive imports, and hence rising inflation.

“That makes things look pretty ugly for retailers, who face an extremely competitive pricing environment, along with the challenge of adapting to changes in consumer behaviour driven by the digital revolution.

“It also doesn’t bode too well for consumers, who may soon face higher prices if retailers can’t entirely defray the higher costs of imports.”

Prof Andrew Fearne, of the University of East Anglia’s Norwich Business School, says this is the first of many stand-offs that could happen as a result of Brexit.

“This is the first of many stand-offs that are inevitable as the implications of Brexit kick in and companies try to navigate a sustainable way forward,” he said.

“The problem is that some companies will use the exchange rate as a vehicle for negotiating price rises that are a) avoidable and b) could leave some of their customers un-competitive, if they agree to pay more when others refuse.

“We don’t have the details of the conversations between the respective buyers and account managers but a blanket call for price hikes sounds unreasonable without the evidence to back up the implications of input cost increases for specific products – the impact of a declining pound on the cost of producing coffee will not be the same as the impact on washing powder or shampoo.

“We have seen these stand-offs before and there is always an element of ‘bluff’ as the retailer tests their shoppers’ loyalty to specific brands looks to exploit the opportunity to encourage brand switching. Tesco are the biggest retailer so their actions always make the news but what we are seeing here is the thin edge of a very long wedge in the world of fast moving consumer goods.”