WASHINGTON ― Republicans on Monday approved their first piece of legislation since taking charge of the House of Representatives: a bill rescinding $71 billion in extra funding for the Internal Revenue Service.

But the bill would actually wind up costing the federal government a lot more than it saved.

The symbolic legislation fulfills a promise to stop President Joe Biden from siccing an imaginary horde of IRS agents on middle-class families across America. Democrats approved the extra funding last year to narrow the gap between what Americans collectively owe the IRS and what they actually pay.

The Congressional Budget Office said Monday that if the Republican bill became law, it would save $71 billion upfront, but cause the government to miss out on $185 billion in uncollected tax revenue for a net loss of $114 billion over a decade. (The bill won’t become law because Democrats still control the Senate and White House.)

“It’s a giant tax cut for rich tax cheats,” White House chief of staff Ron Klain said on Twitter of the Republican bill Monday. “Adds to the deficit.”

The deficit haters at the Committee for a Responsible Federal Budget said the bill would “encourage tax cheating” by making it easier for businesses and individuals to shirk their obligations.

“Increasing funding for the IRS is one of the few ways to raise more revenue without raising taxes, and it has a long history of bipartisan support – including from every recent President from Ronald Reagan through Joe Biden,” the CRFB wrote in a blog post.

Rep. Ron Estes (R-Kan.) sidestepped a question about the deficit impact of the legislation, saying the bill would reduce the audit burden on struggling households.

“The problem is, the IRS by design actually audits lower- and middle-income folks and small businesses more than they do the wealthy individuals,” Estes told HuffPost. (Democrats and the Biden administration have said the IRS would use the funds to audit higher-income households but didn’t include such a requirement in the text of the law.)

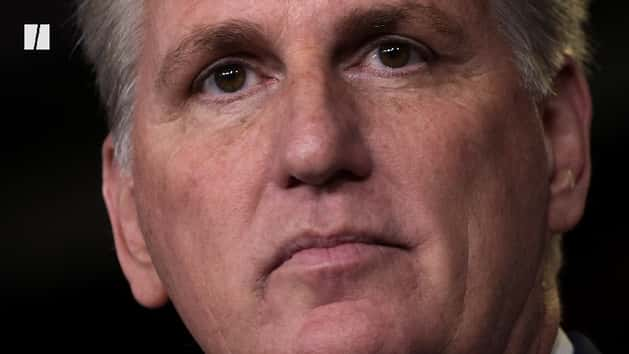

House Speaker Kevin McCarthy (R-Calif.) proclaimed shortly after winning the speaker’s gavel on Saturday that Republicans would “end wasteful government spending.” He won over Republicans who opposed him for speaker partly by promising the House would vote to balance the federal budget over a short time frame.

Slashing IRS funding goes against the goal of balancing the budget, but it fits with a broader Republican complaint that Democrats have “weaponized” the federal government against average Americans. Republicans have claimed the new IRS funding approved last year would result in 87,000 new IRS agents to harass people, although it’s not clear how many new employees would be auditors.

Before the new funding, the IRS budget was 30% lower than it had been a decade ago. Former IRS Commissioner Charles Rettig testified last year that the agency had less than the equivalent of 79,000 full-time staff and that it would need to hire 52,000 people over the next six years just to replace retiring workers. The agency previously estimated it could use a funding boost to increase staffing by 87,000 over 10 years.

Most of the “tax gap” results from households failing to report business income to the federal government. Unlike wage income, which gets reported directly to the federal government so that payroll and income taxes can be deducted, business income isn’t automatically reported.

Rettig, a Republican appointed by former President Donald Trump, insisted the additional funding wouldn’t be used to increase audits on people earning less than $400,000, though the Congressional Budget Office has previously said a “small fraction” of the increased revenue would come from households earning less than that amount.

“These resources are absolutely not about increasing audit scrutiny on small businesses or middle-income Americans,” Rettig said in a letter to senators last summer.